santa clara property tax due date 2021

Proposition 13 the property tax limitation initiative was approved by California voters in 1978. If you are making partial.

2021-2022 county of santa clara secured property taxes -.

. SANTA CLARA COUNTY CALIF The Department of Tax and Collections DTAC representatives remind property owners that the second installment of the 2020-2021 property taxes becomes. Secured property tax bill tax year. Secured property tax bill tax year.

Look up prior years bills and payments. Mary Pope-Handy 408 204-7673. Manage your contact informationyou can tie your account to more than one.

The 25 best Property Tax Santa Clara Due Date images and discussions of May 2022. Santa Clara County collects on average 067 of a propertys. November 01 2021 DELINQUENT TAX DUE County of Santa Clara Department of Tax and Collections 70 West Hedding Street East Wing 6th Floor San Jose California 95110-1767 SECURED PROPERTY TAX BILL TAX YEAR.

This tax payment is based on property values determined for the January lien date 15 months earlier. There are three ways to file the Business Property Statements 571-L 1. See the assessed value of your property.

The County will still assess a 10 penalty plus cost for unpaid taxes beyond the property tax delinquency dates. Unsecured Property annual tax bills are mailed are mailed in July of every year. Standard paper filing 3.

COUNTY OF SANTA CLARA PROPERTY TAXES. The diagram below shows an overview of. Last day to file a business personal property statement without.

The County of Santa Clara Department of Tax and Collections DTAC representatives remind property owners that the second installment of the 2021-2022 property taxes is due February 1. If this day falls on a weekend or. Standard Data Record SDR.

If not paid by 500PM they become delinquent. This penalty will only apply to the balance due. The taxes are due on August 31.

December 10 2021 DUE BY. Novogratz brittany futon sofa April 26 2022 0 Comments 802 pm. Santa clara county property tax due date 2022.

Pay your Property Tax bill online. An explanation of the property tax due dates and fiscal calendar. Property Taxes--Secured and Unsecured The County cities schools and other local taxing agencies.

Property Tax Email Notification lets you. Due date delinquent after taxes and special assessments 10 delinquent penalty delinquent cost. 2021-2022 for July 01 2021 through June 30 2022 ASSESSORS PARCEL NUMBER APN.

SANTA CLARA COUNTY CALIF The County of Santa Claras Department of Tax and Collections has mailed out the 2020-2021 property tax bills to all property owners at the. April 10 - Second installment payment deadline. February 1 - Second installment due on secured tax bills.

Attention Santa Clara County property owners. Property taxes are levied on land improvements and business personal property. FY 2020-21 July 1 2020 through June 30 2021 is the tenth consecutive year in which property taxes collected countywide have increased.

SANTA CLARA COUNTY CALIF The County of Santa Clara Department of Tax and Collections DTAC representatives are reminding property owners that the second installment of the 2020. The second installment of the 2020-2021 property taxes was due February 1 and becomes delinquent at 5 pm on Monday April 12. Trending posts and videos related to Property Tax Santa Clara Due Date.

An explanation of the property tax due dates and fiscal calendar. January 31 2022 DELINQUENT TAX DUE DELINQUENT TAX DUE Special Assessments. 2021-2022 county of santa clara secured property taxes - 1st installment sec-reg-202108 1.

E-Filing your statement via the internet. January 1 - Lien date for all taxes for the coming fiscal year. Review property tax bills any place with an internet connection.

Property taxes are due in two installments about three months apart although there is nothing wrong with paying the entire bill at the first installment. A 10 penalty plus 2000. The fiscal year for.

2021-2022 for july 01 2021 through june 30 2022 assessors parcel number apn. 2021-2022 for july 01 2021 through june 30 2022 assessors parcel number apn. Get email reminders that your taxes are due.

The median property tax in Santa Clara County California is 4694 per year for a home worth the median value of 701000.

Property Tax California H R Block

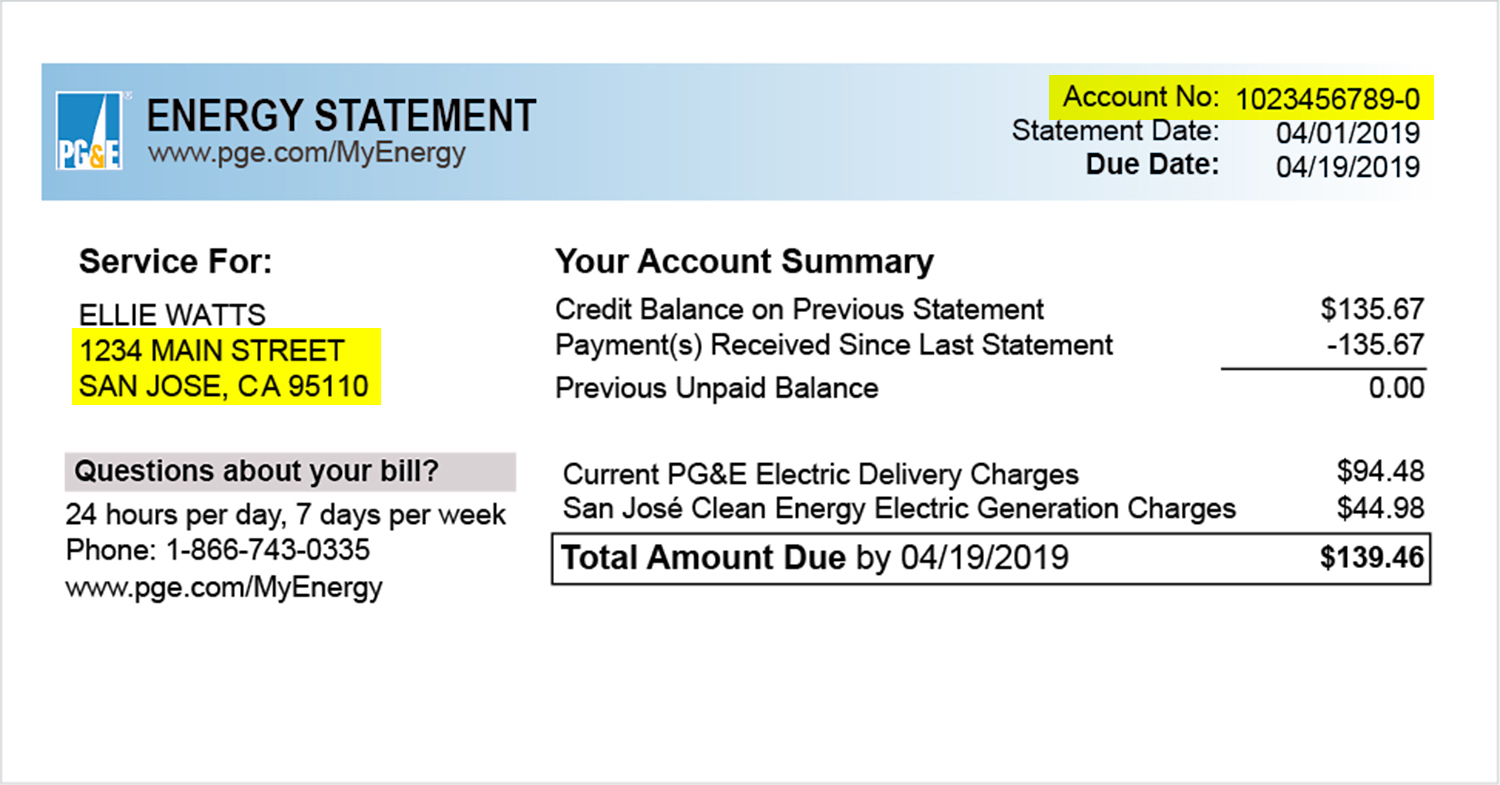

How Can I Be Eligible For San Jose Clean Energy Sjce Funds Calevip

Secured Property Taxes Tax Collector

Rent Registry City Of San Jose

Jul 31 Santa Clara County Fair Drive Thru 2021 San Jose Campbell Ca Patch

Coronavirus Updates The Business Assistance Program Lafayette Chamber Of Commerce