how to calculate nj taxable wages

Your employer uses the information that you provided on your W-4 form to. Calculate hourly employees wages by multiplying the number of hours worked by their pay rate including a higher rate for any overtime hours worked.

State Corporate Income Tax Rates And Brackets For 2022 Tax Foundation

The states SUTA wage base is 7000 per.

. Ad Ideal For Busy Families and Budgets. Employers in California are subject to a SUTA rate between 15 and 62 and new non-construction businesses pay 34. So if you earn 10 an hour enter 10 into the salary input and select Hourly Optional Select an alternate state the.

See What Credits and Deductions Apply to You. Salary Paycheck Calculator New Jersey Paycheck Calculator Use ADPs New Jersey Paycheck Calculator to estimate net or take home pay for either hourly or salaried employees. To use our New Jersey Salary Tax Calculator all you have to do is enter the necessary details and click on the Calculate button.

All new employers except successors are assigned new employer rates for the first three calendar years after which a calculated rate is assigned based on employment experience. See what makes us different. Enter Your Tax Information.

Check the box - Advanced NJS Income Tax Calculator Confirm Number of Dependants Confirm Number of Children you. Three-Year Rule Method and General Rule Method. Ad E-File your tax return directly to the IRS.

Once you have the gross amounts being taxed by New York then you need to figure out how much you are taxed. A Payments made to employees under an approved private plan are considered taxable remuneration if payments are for a period of less than seven consecutive days following the. Because of these and other differences you must take the amount of wages from the State wages box on your W-2s Box 16.

Prepare federal and state income taxes online. If you use the Three-year Rule Method your pension is not. If you estimate that you will owe more than 400 in New Jersey Income Tax at the end of the year you are required to make estimated payments.

Federal income taxes are also withheld from each of your paychecks. How to use the advanced New Jersey tax calculator Enter your income. Also check your W-2 to confirm that New Jersey.

The state income tax rate in New Jersey is progressive and ranges from 14 to 1075 while federal income tax rates range from 10 to 37 depending on your income. How to Calculate Withhold and Pay New Jersey Income Tax Withholding Rate Tables Instructions for the Employers Reports Forms NJ-927 and. O You can exclude from New.

We dont make judgments or prescribe specific policies. There are two methods you can use to calculate these amounts. Estimate Your Taxes And Refunds Easily With This Free Tax Calculator From AARP.

Enter your salary or wages then choose the frequency at which you are paid. Calculate your taxable income Adjusted gross income Post-tax deductions Exemptions Taxable income understand your tax liability Taxable income Tax rate Tax. How Your New Jersey Paycheck Works.

Ad Enter Your Status Income Deductions And Credits And Estimate Your Total Taxes. To figure this out add up the New York tax withheld from. After a few seconds you will be provided with a full breakdown.

Gross wages - Non-taxable wages - Pre-tax deductions Taxable benefits Taxable wages The best payroll software. Easy Tax Preparation Management. Here is the formula for calculating taxable wages.

Income Actually Taxed by Both NJ and Another Jurisdiction Income Taxable in Another Jurisdiction Exempt From Tax in NJ Income must be taxed by bothNew Jersey and the other. Ad Non-partisan not-for-profit resource for US data statistics on a variety of topics.

2021 New Jersey Payroll Tax Rates Abacus Payroll

Road To Recovery Reforming New Jersey S Income Tax Code New Jersey Policy Perspective

New Jersey State Tax Refund Nj State Tax Brackets Taxact Blog

2019 New Jersey Payroll Tax Rates Abacus Payroll

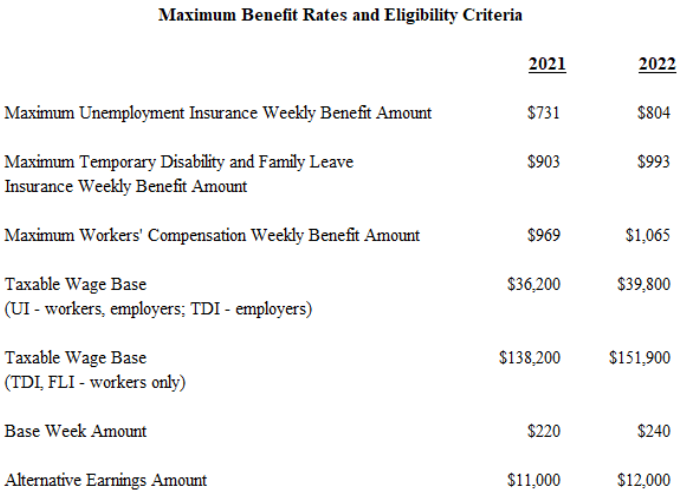

Department Of Labor And Workforce Development Nj Department Of Labor And Workforce Development Announces Benefit Rate Increases For 2022

New Jersey Nj Tax Rate H R Block

Nj Takes Another Look At Tax Bracketing Nj Spotlight News

Pay Stub Templates 10 Free Printable Word Excel Pdf Science Words Templates Words

Non Resident Alien Graduate Student Tax Treaty Country

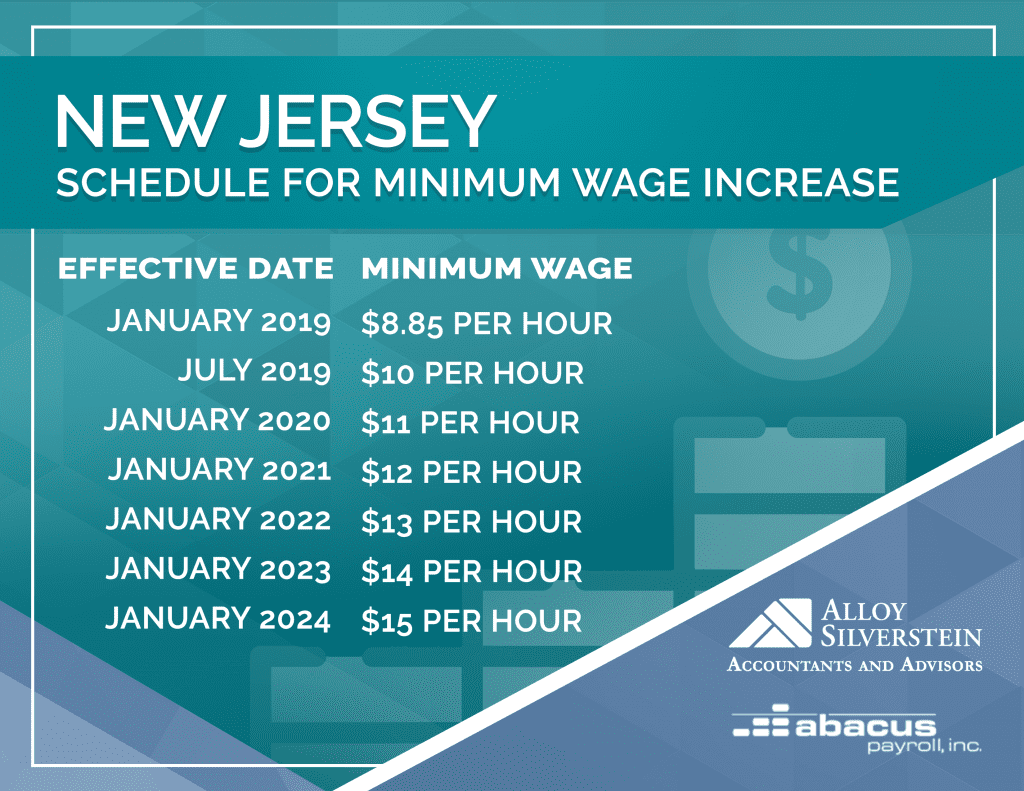

New Jersey Minimum Wage Increase Bad For Business Alloy Silverstein

New Jersey State Taxes 2021 Income And Sales Tax Rates Bankrate

Cashing In How The New Jersey Minimum Wage Increase Will Affect Tipped Employees Citrin Cooperman

Aatrix Nj Wage And Tax Formats

Aatrix Nj Wage And Tax Formats

2018 New Jersey Payroll Tax Rates Abacus Payroll

Aatrix Nj Wage And Tax Formats

2020 New Jersey Payroll Tax Rates Abacus Payroll

New Jersey Minimum Wage Increase Bad For Business Alloy Silverstein

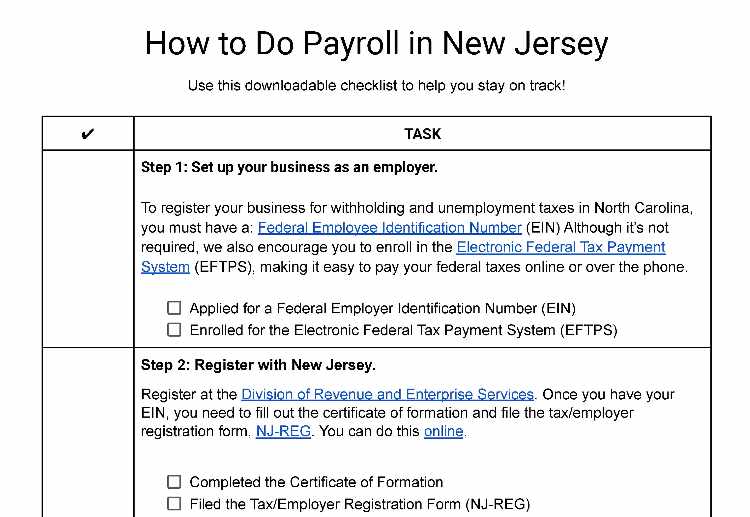

How To Do Payroll In New Jersey Everything Business Owners Need To Know